Call us today!

Call us today!

Your Health & Wealth

Bodyguard

Our Latest Insights: Blog & Resources

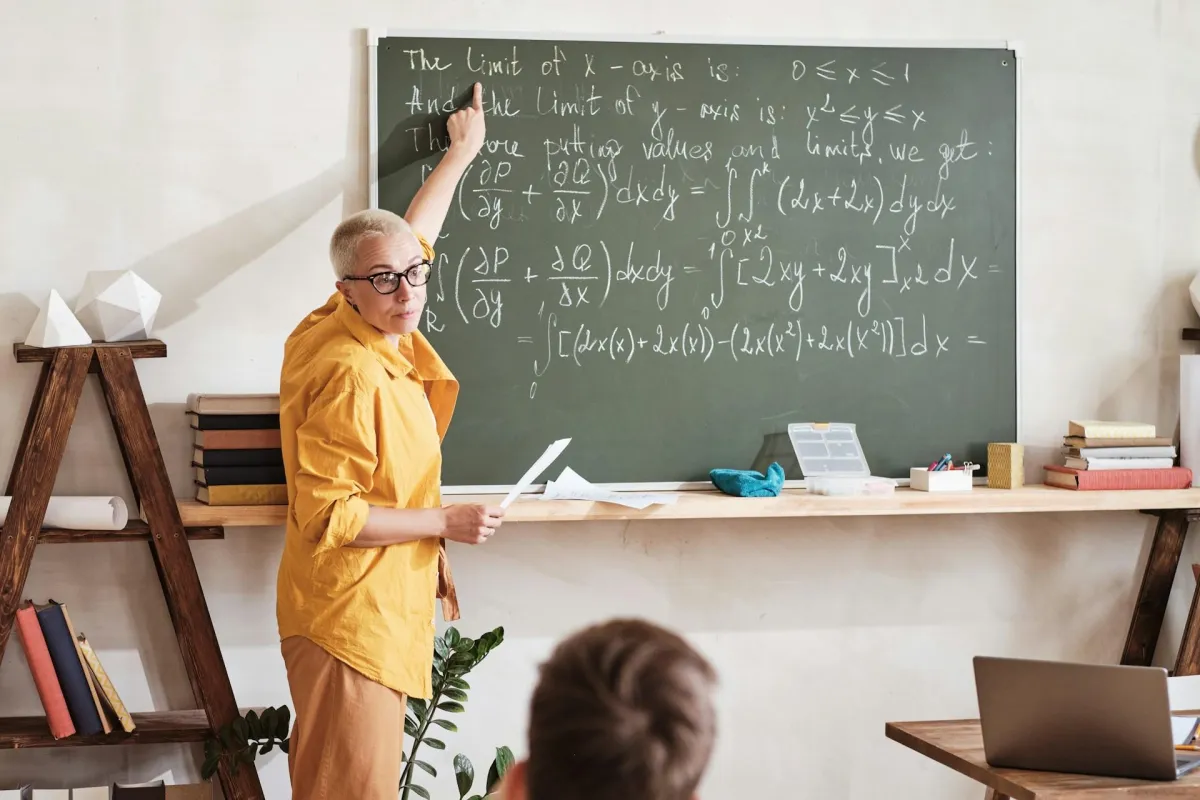

Building a Strong Retirement Fund as a Teacher

Building a strong retirement fund is crucial for teachers who want to enjoy a secure and comfortable future. As an educator, you have unique opportunities and challenges when it comes to preparing for retirement. Understanding your pension plan and exploring additional retirement accounts can vastly improve your financial stability.

The key to a robust retirement fund lies in how well you know and manage your resources. Your pension plan is a vital part of this puzzle, but relying solely on it may not be enough. Adding other retirement accounts and increasing your savings through smart strategies can make a world of difference. It’s all about taking the right steps at the right time.

Financial checkups play a significant role in ensuring your retirement plan remains effective. Just like regular health checkups keep you healthy, financial reviews help you stay on track with your goals.

Knowing where you stand and making necessary adjustments can go a long way in securing your financial well-being. Let's dive into how you can build a strong retirement fund with these key elements.

Understanding Your Pension Plan and Benefits

As a teacher, one of your biggest retirement assets is your pension plan. It’s important to fully understand how it works and the benefits it offers. Your pension plan typically involves regular contributions from your salary, which are then invested to grow over time. When you retire, you receive a steady income based on the number of years you’ve worked and your average salary during your highest-earning years.

Knowing the specifics of your pension plan can help you make informed decisions. For example, find out how much you and your employer contribute. Understand the formula used to calculate your benefits, and try to estimate how much monthly income you can expect when you retire. This information can help you identify any gaps and plan accordingly.

Pension plans also often include additional benefits like cost-of-living adjustments, survivor benefits, and disability benefits. Make sure you’re aware of these, as they can provide extra financial security. Understanding these aspects of your pension plan ensures you’re making the most of what’s available to you and helps you plan for a more secure retirement.

Exploring Additional Retirement Accounts

Relying solely on your pension plan might not be enough to secure a comfortable retirement. That's why exploring additional retirement accounts can be very beneficial. One popular option is the 403(b) plan, which is specifically designed for educators and non-profit employees. You can contribute a portion of your salary before taxes, and the investments grow tax-deferred until you withdraw the money in retirement.

Another helpful option is a Roth IRA. With a Roth IRA, you contribute after-tax income, but your withdrawals during retirement are tax-free. This can be especially beneficial if you expect to be in a higher tax bracket when you retire. Having a mix of taxable and tax-free income sources can give you more flexibility in managing your retirement funds.

Some teachers also have access to 457(b) plans. These plans are similar to 403(b) plans but offer different rules regarding withdrawals, often allowing penalty-free withdrawals if you retire early. By utilizing a combination of these accounts, you can create a more diversified and resilient retirement portfolio.

Exploring these options allows you to take advantage of various tax benefits and investment opportunities. This diversification strengthens your retirement fund and gives you more financial security and flexibility when you retire.

Strategies for Increasing Your Retirement Savings

Boosting your retirement savings doesn’t have to be complicated. There are simple, effective strategies you can implement to enhance your financial future. One of the easiest ways is to increase the percentage of your salary that you save each year. Even a small increase can accumulate significantly over time.

Take advantage of employer matching contributions if your school district offers them. If they match a certain percentage of your savings, make sure you’re contributing at least that amount to get the full benefit. It’s essentially free money that goes directly into your retirement fund.

Automating your savings can also be highly beneficial. Set up automatic transfers from your checking account to your retirement accounts. This ensures that you’re consistently saving without having to think about it each month. You’re less likely to miss those funds if they’re automatically allocated.

Consider also diversifying your investments. Don’t put all your money into one type of asset. Spread it across stocks, bonds, and other investment vehicles to reduce risk and increase potential returns. Regularly reviewing and adjusting your investment strategy can help you stay on track and maximize your savings.

The Importance of Regular Financial Checkups

Just like you see a doctor for regular health checkups, you need to perform regular financial checkups to keep your retirement plan on track. Regularly reviewing your financial situation allows you to make necessary adjustments and ensures that you’re meeting your goals.

Start by setting a schedule for these reviews—quarterly or annually works well for most people. During these reviews, assess your current savings, investment performance, and spending habits. Check if you’re on track to meet your retirement goals and make adjustments as needed.

A good financial checkup also involves reviewing your pension plan and any additional retirement accounts. Make sure you’re aware of any changes in contribution limits, tax laws, or investment options that could affect your savings strategy. Keeping informed can help you take advantage of any new opportunities to boost your retirement fund.

Consulting with a financial advisor can provide valuable insights and personalized advice. They can help you identify potential gaps in your plan and suggest strategies to fill them. Regular financial checkups not only keep you on track but also provide peace of mind, knowing that you’re taking the right steps for a secure retirement.

Creating a Strong Retirement Nest Egg for Teachers

Building a strong retirement fund as a teacher involves more than just relying on your pension plan. Exploring additional retirement accounts, implementing strategies to increase your savings, and performing regular financial checkups can make a significant difference in your financial security.

By taking these steps, you ensure that you’re not only prepared for retirement but also able to enjoy it to the fullest. Your pension plan is a great foundation, but it’s the additional efforts you make that will provide a comfortable and worry-free retirement.

If you’re looking to get serious about your retirement planning and want personalized advice, consider reaching out to R&C Financial. We specialize in tailored pension and wealth solutions for educators. Schedule a consultation with our team of the best financial advisors in Florida today to secure your financial future!